Phoenix Sales Tax 2025

Phoenix Sales Tax 2025. Look up any phoenix tax rate and calculate tax based on address. Arizona has state sales tax of 5.6%, and allows local governments to collect a local option sales tax of up to 5.3%.

Arizona has state sales tax of 5.6%, and allows local governments to collect a local option sales tax of up to 5.3%. The combined rate used in this calculator (8.6%) is the result of the arizona state rate (5.6%), the 85050’s county.

There Is No Applicable Special Tax.

The 85050, phoenix, arizona, general sales tax rate is 8.6%.

The Current Sales Tax Rate In Phoenix, Az Is 8.6%.

The total sales tax rate in phoenix comprises the arizona state tax, and the sales tax for maricopa county.

Phoenix Sales Tax 2025 Images References :

Source: www.azcentral.com

Source: www.azcentral.com

Light rail, streetcar focus of proposed Phoenix sales tax, Phoenix in arizona has a tax rate of 8.6% for 2024, this includes the arizona sales tax rate of 5.6% and local sales tax rates in phoenix totaling 3%. The corresponding business codes will be adjusted by an incremental.

Source: www.allaboutarizonanews.com

Source: www.allaboutarizonanews.com

Sales Taxes Set To Increase In A PhoenixArea City All About Arizona News, Easily look up rates and estimate sales tax for phoenix, arizona with our best in class calculator. What is the sales tax in phoenix?

Source: www.chegg.com

Source: www.chegg.com

Solved Problem 401 The following information is related to, The 85050, phoenix, arizona, general sales tax rate is 8.6%. What is the sales tax in phoenix?

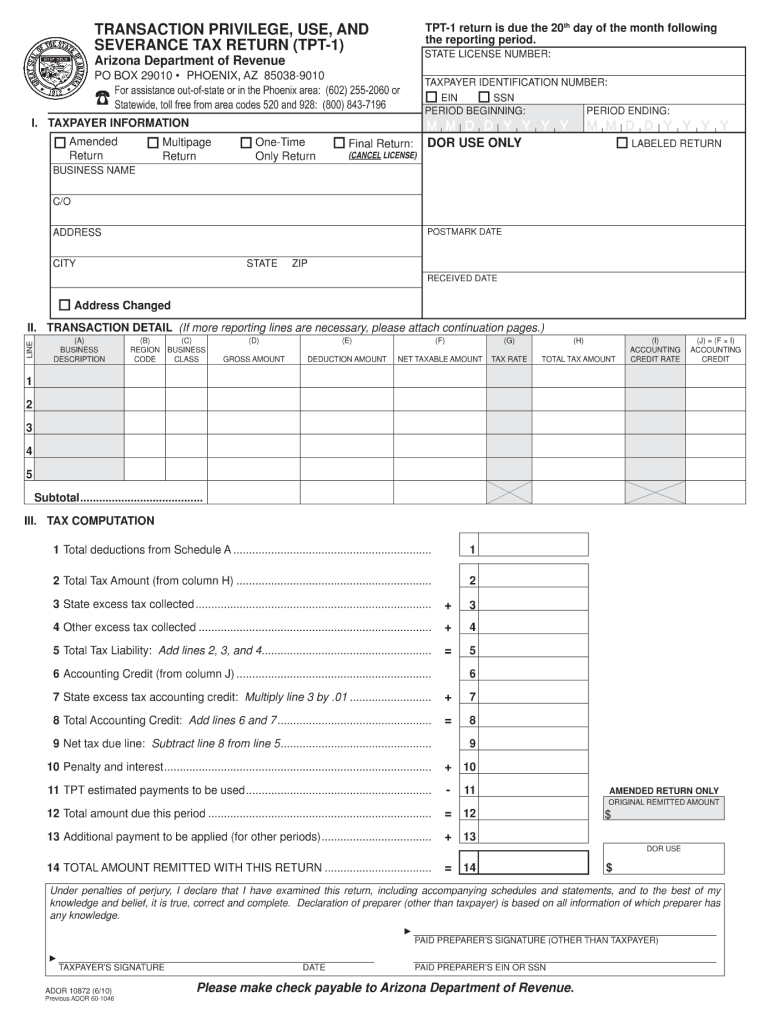

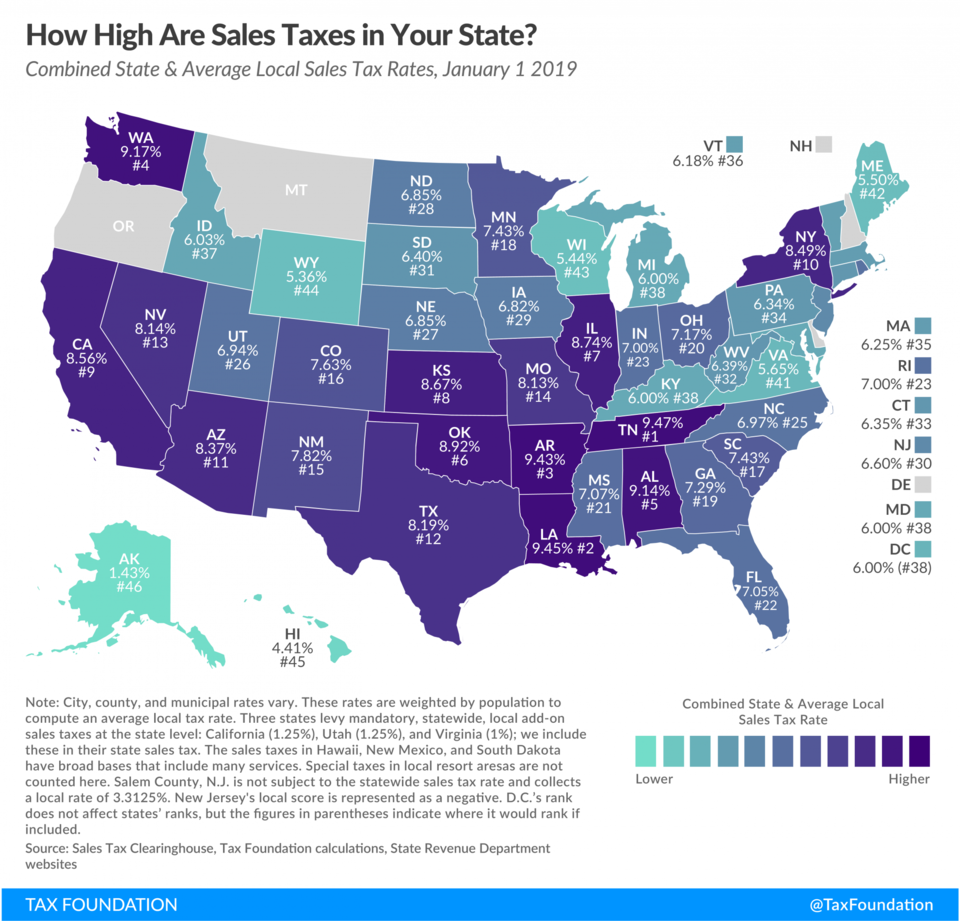

Source: taxfoundation.org

Source: taxfoundation.org

To What Extent Does Your State Rely on Sales Taxes? Tax Foundation, Get information about online options available for paying sales taxes, filing tax returns, managing your business account, and reviewing history. For all new residential leases starting on january 1, 2025, or later, the lease should not include rental taxes.

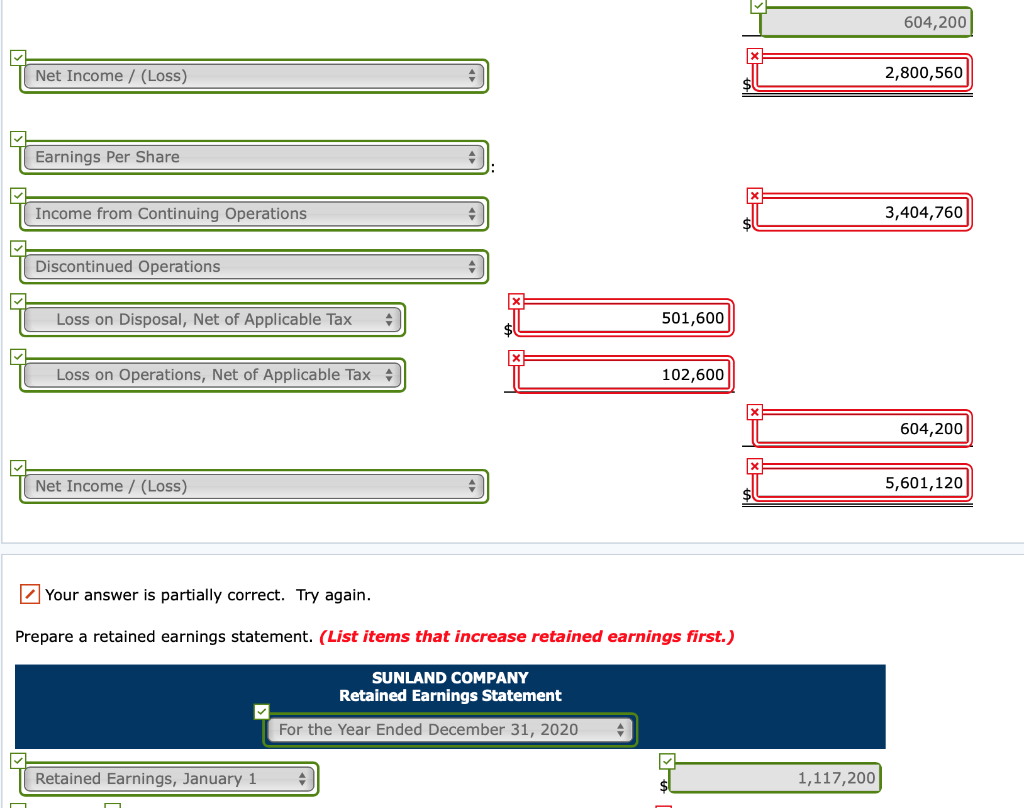

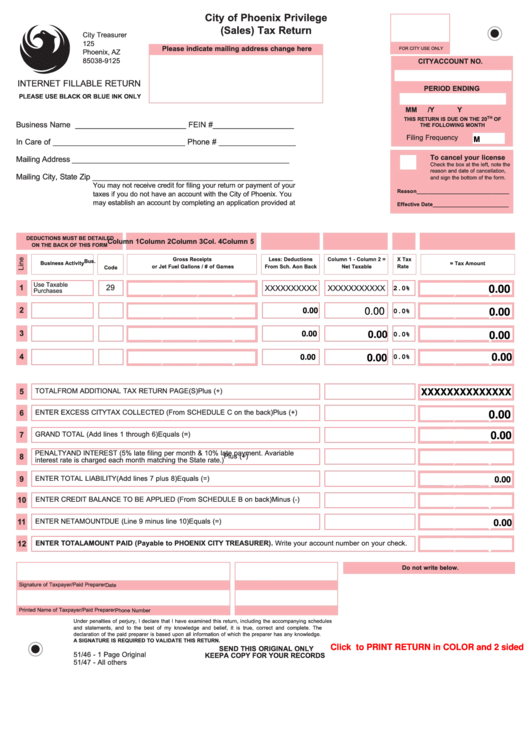

Source: www.formsbank.com

Source: www.formsbank.com

City Of Phoenix Privilege (Sales) Tax Return Instruction Sheet City, Phoenix in arizona has a tax rate of 8.6% for 2024, this includes the arizona sales tax rate of 5.6% and local sales tax rates in phoenix totaling 3%. In arizona, the sales tax rate can be made up of three different sales tax rates:.

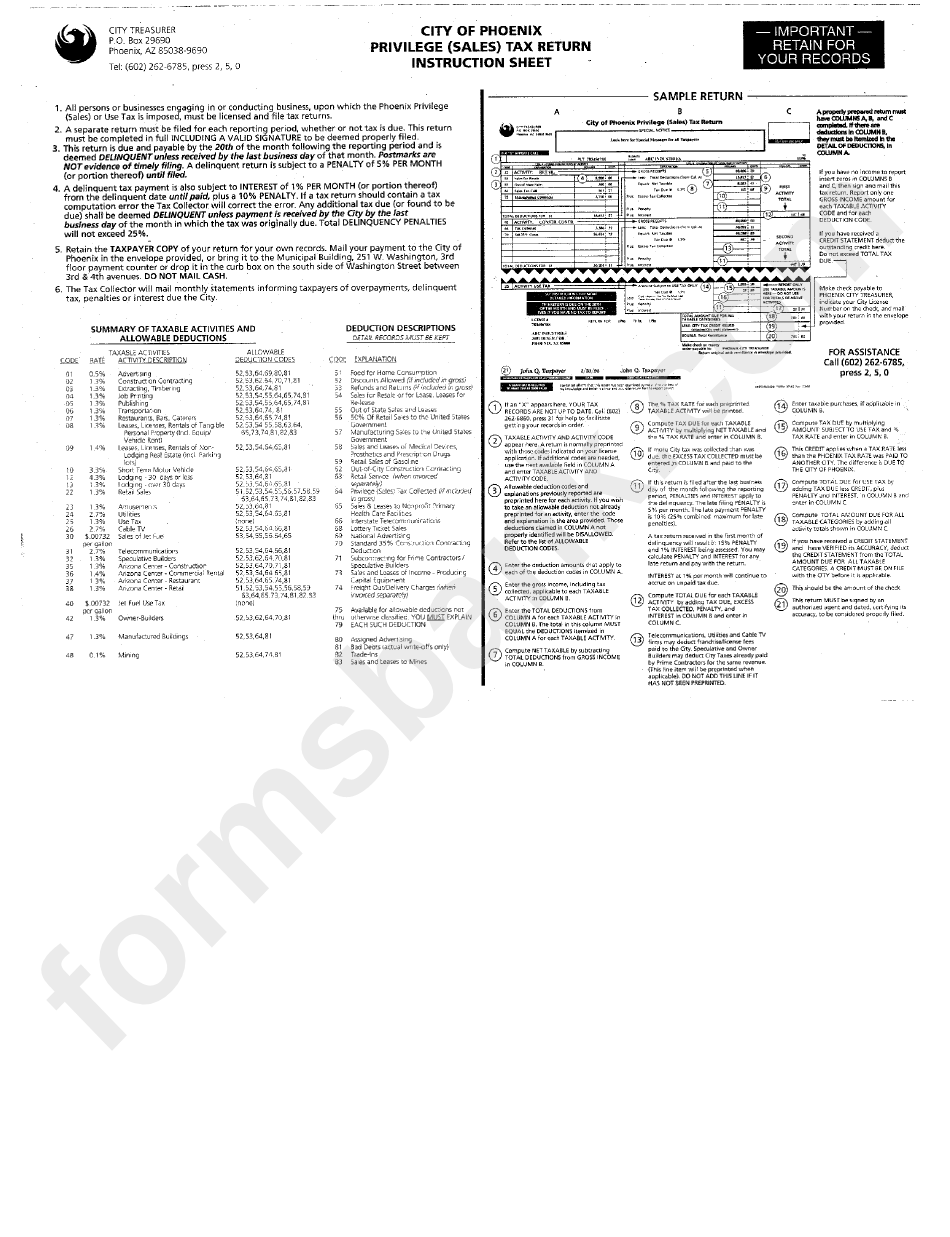

Source: www.signnow.com

Source: www.signnow.com

City of Phoenix Arizona Sales Tax Form Fill Out and Sign Printable, Look up any phoenix tax rate and calculate tax based on address. Republican leaders say the rental relief bill will save tenants in 70 arizona cities and towns between $20 and $200 monthly.

Source: cronkitenewsonline.com

Source: cronkitenewsonline.com

Arizona’s combined sales tax rate is secondhighest in the nation, For all new residential leases starting on january 1, 2025, or later, the lease should not include rental taxes. Republican leaders say the rental relief bill will save tenants in 70 arizona cities and towns between $20 and $200 monthly.

Source: landinghelp.com

Source: landinghelp.com

미국 주별 판매세 (Sales Tax) 비교 Landing Help 코네티컷 뉴헤이븐 지역, On august 1, 2023, governor hobbs signed sb 1131, a bill that prohibits a city, town, or county from levying a tax on residential rentals. Current combined tax rates (phoenix, state, county) rates effective january 1, 2024 through present.

Source: fillableforms.net

Source: fillableforms.net

City Of Phoenix Sales Tax Return Fillable Fillable Form 2023, On august 1, 2023, governor hobbs signed sb 1131, a bill that prohibits a city, town, or county from levying a tax on residential rentals. The combined rate used in this calculator (8.6%) is the result of the arizona state rate (5.6%), the 85050's county.

Source: formspal.com

Source: formspal.com

Phoenix Az Sales Tax Form ≡ Fill Out Printable PDF Forms Online, There is no applicable special tax. The combined rate used in this calculator (8.6%) is the result of the arizona state rate (5.6%), the 85050's county.

The Arizona Sales Tax Rate Is 5.6% As Of 2024, With Some Cities And Counties Adding A Local Sales Tax On Top Of The Az State Sales Tax.

Current combined tax rates (phoenix, state, county) rates effective january 1, 2024 through present.

The Combined Rate Used In This Calculator (8.6%) Is The Result Of The Arizona State Rate (5.6%), The 85050'S County.

There are a total of 99 local tax jurisdictions across the state,.

Category: 2025