Sep Contribution Limit 2025

Sep Contribution Limit 2025. Employers can contribute up to 25% of their compensation up to $66,000 for 2023 and $69,000 for 2025. These contribution limits reflect the 2023 tax year and apply.

For 2025, the ira contribution limits are. In 2025, the cap has ascended to $61,000, a testament to the system’s responsiveness to the evolving needs of those treading the path to financial security.

Sep Ira Contribution Limits Are Higher Than Most Options, Which A Max Contribution Limit Of Up To $66,000 For 2023 And $61,000 For 2022.

The irs released the retirement contribution limits for 2025 1 and we are breaking it down for you.

The Contribution Limit For A Sep Ira Is The Lesser Of:

The ira contribution limits for 2023 are $6,500 for those under age 50 and $7,500 for those 50 and older.

These Contribution Limits Reflect The 2023 Tax Year And Apply.

Images References :

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, Sep ira contribution limits are higher than most options, which a max contribution limit of up to $66,000 for 2023 and $61,000 for 2022. 2025 sep ira contribution limits.

Source: www.irstaxapp.com

Source: www.irstaxapp.com

SEP IRA Contribution Limits with Calculator for Self Employed Persons, 25% of the employee's compensation, or. These contribution limits reflect the 2023 tax year and apply.

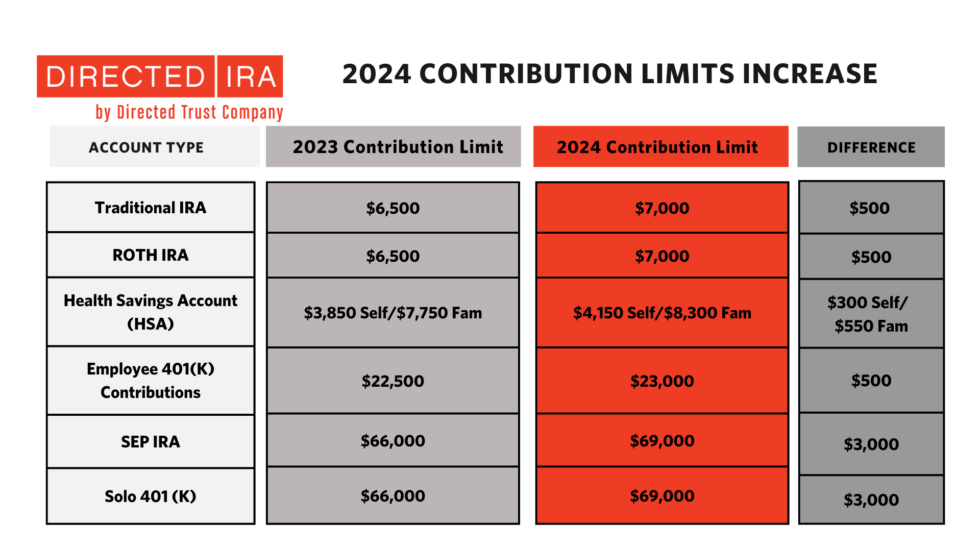

Source: directedira.com

Source: directedira.com

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, That limit jumps to $345,000 in 2025 and is adjusted annually by the irs. 2025 tax rates, schedules & contribution limits.

![SEP IRA Contribution Limits [2023 + 2025]](https://wealthup.com/wp-content/uploads/SEP-IRA-contribution-limits.jpg) Source: wealthup.com

Source: wealthup.com

SEP IRA Contribution Limits [2023 + 2025], Employers can contribute up to 25% of their compensation up to $66,000 for 2023 and $69,000 for 2025. 529 contribution limits are set by each state plan and generally apply a total account limit per beneficiary.

Source: stopbeingsold.com

Source: stopbeingsold.com

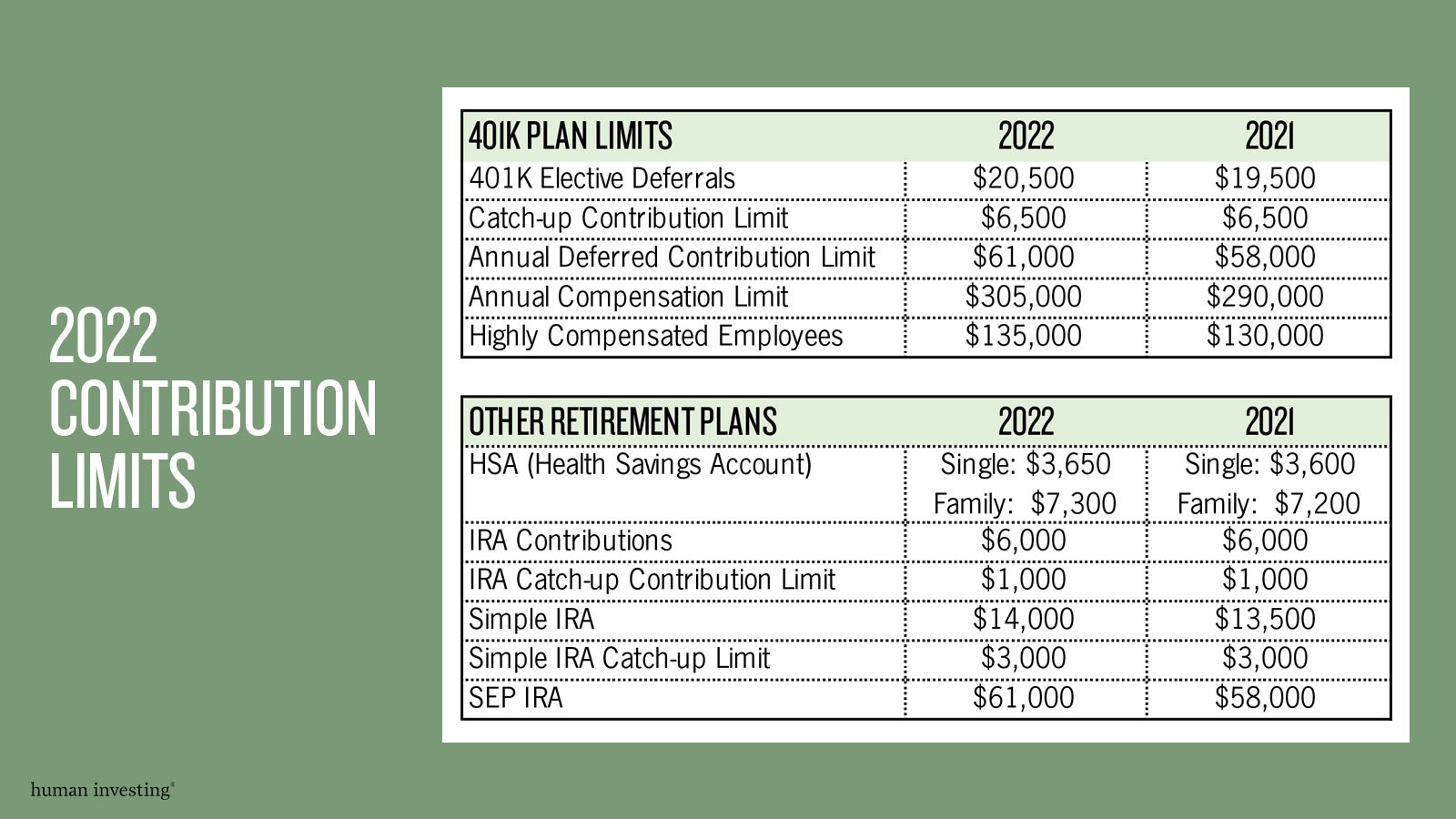

2022 Retirement Plan Contribution Limits Stop Being Sold, What are the sep ira contribution limits for 2025? 25 percent of the employee’s compensation;

Source: www.humaninvesting.com

Source: www.humaninvesting.com

The IRS Has Increased Contribution Limits for 2022 — Human Investing, Sep ira contribution limits for 2023. Morgan professional to begin planning your 2025.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2025, If you have employees you may. $69,000 for 2025 ($66,000 for 2023, $61,000 for 2022,.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2025 Contribution Limit Chart, They range from $235,000 to upward of $500,000. Morgan professional to begin planning your 2025.

.png) Source: www.augur.cpa

Source: www.augur.cpa

Due Dates & Limits for SEP IRA Contributions (2025) Augur CPA Blog, Employers can contribute up to 25% of their compensation up to $66,000 for 2023 and $69,000 for 2025. These contribution limits reflect the 2023 tax year and apply.

What’s New for Retirement Saving for 2025?, This limit is $345,000 in 2025,. In 2025, the cap has ascended to $61,000, a testament to the system’s responsiveness to the evolving needs of those treading the path to financial security.

Irs &Amp; Social Security Administration Updates, 2025.

This limit has increased from $60,000 in.

The Total Contribution Limit Is The Same For A Solo 401(K) And Sep Ira ($66,000 For 2023;

The contribution limit for a sep ira is the lesser of: